This is for investors, people interested in investing, but also probabilities or stats

Me, like most investors, spend most of my time looking for the right investments.

Yet forget the part that makes up to 80% of success.

sizing is 70-80% of the equation

Investing too much is the biggest tax I´ve ever paid.

But it´s completely avoidable.

And here you´ll find how.

I systematized it after loosing 33% of my portfolio.

Based on the framework of the leading psychologist, Daniel Kahnemann.

You´ll read:

Why it´s important and how big those mistakes can be,

the framework how to solve it, and

we´ll apply this to an actual investment

Table of Contents

“This must work”

It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.

It’s not so bad when you don’t know something, because you can always learn it.

The real problem happens when you believe something is true—without a doubt—but it turns out to be wrong.

That’s what can get you into the biggest trouble.

I lost a third of my savings in a single bet.

Not because the market crashed.

Not because the company failed.

But because I broke the cardinal rule of position sizing.

Here´s the painful math:

90% of startups fail completely

Only 1.5% ever exit above $50M

Yet I bet 33% of my portfolio on one moonshot

Pure delusion?

Not exactly.

When you´re convinced the odds are in your favor, sizing up is a must.

The mathematical move.

Stanley Druckenmiller, a hedgefund-manager with an average of 33% annual return (which is higher than Warren Buffets), says,

Sizing is 70% to 80% of the equation. Part of the equation is seeing the investment, part of the investment is seeing myself in a good trading rhythm. It’s not whether you’re right or wrong, it’s how much you make when you’re right and how much you lose when you’re wrong,

But here´s the trap: I confused conviction with probability.

While I was dreaming of unicorns, the cold statistics painted a different picture.

A 1.5% success rate doesn't justify a 33% position.

Not even close.

The gap between my gut estimate and reality wasn't just wide – it was catastrophic.

This isn't just about having a strategy. It's about having the discipline to stick to it when your emotions scream "all in."

I had neither.

The worst part?

This mistake was completely avoidable.

The data was there. The warnings were clear. But overconfidence made me blind to both.

Let´s break down the brutal math of my mistake:

Position size: 33% of my portfolio on one bet.

This mathematically implies a average win rate of such an investment of: 66%.

Actual success rate of a startup becoming a unicorn? 1% or less.

Optimal allocation: ~0.01%

I overbet by 6,600x. Read that again. I overbet by 6,600x.

This isn´t just a small mistake.

It´s an example that you could put in a textbook (it´s like the guy who buys 397 watermelons).

The only real mistake is the one from which we learn nothing.

So I turned my x-figure lesson into a masterclass on Psychology and Position Sizing.

Here´s what I discovered:

I´d fallen for the matching bias - that sneaky mental trap where you assume your gut feeling resembles real-life probabilities.

You know the feeling:

"This is such a great idea, this must work!"

"This one´s different"

"I´ve done my reserach"

It´s like the drunken guy who looks for his key only where he can see.

I used the information that I knew only, but the truth was totally dark for me.

This revelation led me to Daniel Kahnemann's work.

The Nobel laureate who's spent decades studying why smart people make dumb decisions.

What he revealed changed everything about how I invest.

He shows a systematic way to bridge the gap between intuition and reality.

I've distilled his insights into a framework so practical, so powerful, that I now use it on every single trade.

No exceptions.

The best part?

It doesn't kill conviction.

It calibrates it.

It's not complicated.

It's not sexy.

But it works.

Let me show you how.

The Process (5 steps)

Have a clear strategy for your investment. At least the following

Potential win: at what price do you plan to sell if it goes well?

potential loss: at what price do you plan to sell if it goes bad?

maximum loss you can handle with one investment, psychological or financially

this should be your maximum position size of your portfolio

for me personally, this is especially my maximum loss I feel comfortable with, or half-kelly. Whichever of those two is lower.

Make your intuitive guess on the success-rate:

How likely do you think is this going to succeed?

this is what you make your guess based on

look up the base-rate / average success-rate:

how likely is this type of investment to succed, on average?

how did it perform in the past?

might there be a reason why it should perform worse in the future?

Estimate the diagnostic value of the information you have

How deep is your expertise in this area?

What's your verified track record?

Where are your blind spots?

Remember: Knowledge is like streetlights – the more you have, the better you see what's actually there, not just what you hope to find.

Calibrate your position. This is where rationality beats emotion.

Start with the statistical average (reality)

Weight your gut feeling by your expertise

Calculate how far you go from the statistical average to your personal result

The magic isn't in following each step.

It's in doing all five, every single time.

No exceptions.

No rationalizations.

No "this time it's different."

Because it never is.

Applying the 5-steps to Junior Mining

Let's Get Practical: Junior Mining Edition

Here's my exact process for sizing a mining exploration bet:

1. Have a clear strategy

My strategy:

Maximum position: 10% or half-Kelly (whichever is smaller)

Win target: 7x (600% gain) (this means 1,000$ → 7,000$)

Loss limit: -50% (this means 1,000$ → 500$)

Investment Thesis behind my strategy: Company advances to next development stage

2. Intuitive guess

My intuitive guess.

After listening to their presentation and doing some reserach, I think this investment has a 50% chance of being succesfull.

3. Looking up the base rate / statistical average

For finding those, we need to first understand how classify different stages.

We keep it simple and stupid.

Enough for our purpose.

Stages of a Mine

Breaking this down into four critical stages:

Grassroots Exploration: Geologists with dreams and magnetic data. Sitting on their desks, looking for the needle in Earth's haystack. Maybe hiking through the mountains, picking up some rocks

Advanced Exploration: Drills hit the ground. Proof of what's below the surface.

Development Projects: Engineering takes over. Turning geology into economics.

Profitable Mine: Where dirt becomes dividends. Finally a product is sold. Cash comes in through revenues.

With the stages at hand, we can set-out to find data on this.

Success rates of mines (in each stage)

Now, about those odds. Here's what Michael told me last summer:

I think there is a statistic for, for every thousand discoveries, one becomes a mine. I'm sure it's now 1,500 to 2,000 becomes a mine. Like that's how difficult it is, and just, To show you where the commodity cycle is or where it's beginning on the copper side, which, commerce, copper's arguably the most important metal on base of the earth. We've made since 1990, what, 224 copper discoveries, only 10 in the last 10 years. So it's not an easy business, but there's scarcity

The most cited statistic I found confirms this:

1,000 grassroots projects →

100 advanced targets →

10 development projects →

1 profitable mine

RioTinto suggests, it´s only 1 out of 3,000 becomes a profitable mine.

Some studies, like from the Ontario Mining Association, suggest only 1 in 10,000 projects reach production.

Another crucial insight from Michael W. about finding quality:

There's 2000 companies in Canada. There's probably 200 really good ones with either good assets or very prospective projects. So it's, you're only looking at 10 percent of all the companies. You want to have a company that has a little legitimate shot at success

Introducing a real case

Let's put this framework to work on a real bet:

My Project's Profile:

Stage: Advanced exploration

Target: this will go into the Development phase

statistical average, based on the studies shown before: 5-10%

4. Estimate the diagnostic value

How much is my knowledge worth?

Let´s assess my “edge”:

3 years in mining investing, a few more in investing overall.

No geologist credentials

Haven't lived through a full market cycle

But solid understanding of company analysis. Im a certified Financial Modeling & Valuation Analyst.

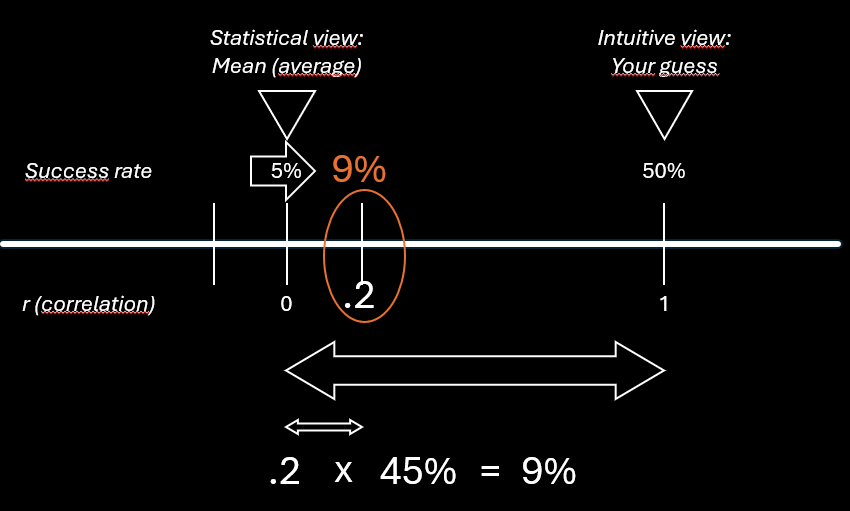

→ with this in mind, I´d rate it at 20% (gotta start being honest with myself … )

5. Calibrate your position

Now we´ve got all the information we need.

Let´s use those and adjust the gut estimate back to the statistical average, based on the worthiness we´ve put on my sector knowledge:

Gut says 50% chance of success

Experience weight: 20% (gotta be honest with myself)

so we start at 5%. We go 20% of the way to what my gut said, which is 20% of 45%.

Final probability: 9%

We´ve now calibrated our assumption for the win-rate of our investment-case.

Next step is deciding how much money to put into that investment.

I like math:

Portfolio: $100K example

Half-Kelly calculation with 9% success rate

Position size: 1.4% ($1,400)

That's right.

Despite my conviction, the math says $1,400 – not the $33,000 my emotions might suggest (or have made me invest in the example from the beginning).

This isn't about being timid.

It's about surviving long enough to catch the winners that matter.

I hope you learned something.

If you have struggle understanding this, please write in the comments or message me on any channel.

I´m more than happy to help out.

Cheers.